Debt Consolidation vs Debt Relief: 20 Key Differences Explained

When you're struggling with debt, two common strategies to regain control of your finances are

debt consolidation and

debt relief. But what’s the difference?

In today’s post, you will learn about the

20 key differences between debt consolidation and debt relief to help you understand which might be the right option for your financial situation.

First, we will cover some important related concepts to ensure a clear understanding. Then, we will provide examples for each difference. This will help you find clarity on which option might be best suited for your financial situation.

Keep reading!

What is Debt Consolidation?

Debt consolidation involves combining multiple debts into a single loan or payment. This approach simplifies managing your debt by reducing the number of creditors, but it doesn’t lower the total amount owed.

What is Debt Relief?

Debt relief reduces the total debt owed by negotiating with creditors. This option is typically pursued when individuals are struggling to make payments and need immediate relief.

It is also a broad term encompassing various strategies to reduce or manage debt. This can include debt settlement, debt consolidation, refinancing, and even bankruptcy.

Key Differences Between Debt Consolidation and Debt Relief

Before we tell you about the 20 differences between these two financial strategies, we would like you to know in a summary that

debt consolidation simplifies your financial obligations by reducing the number of creditors you owe, and combining multiple debts into a single, manageable loan.

On the other hand, debt relief focuses on reducing the total amount of debt you owe through negotiations with creditors.

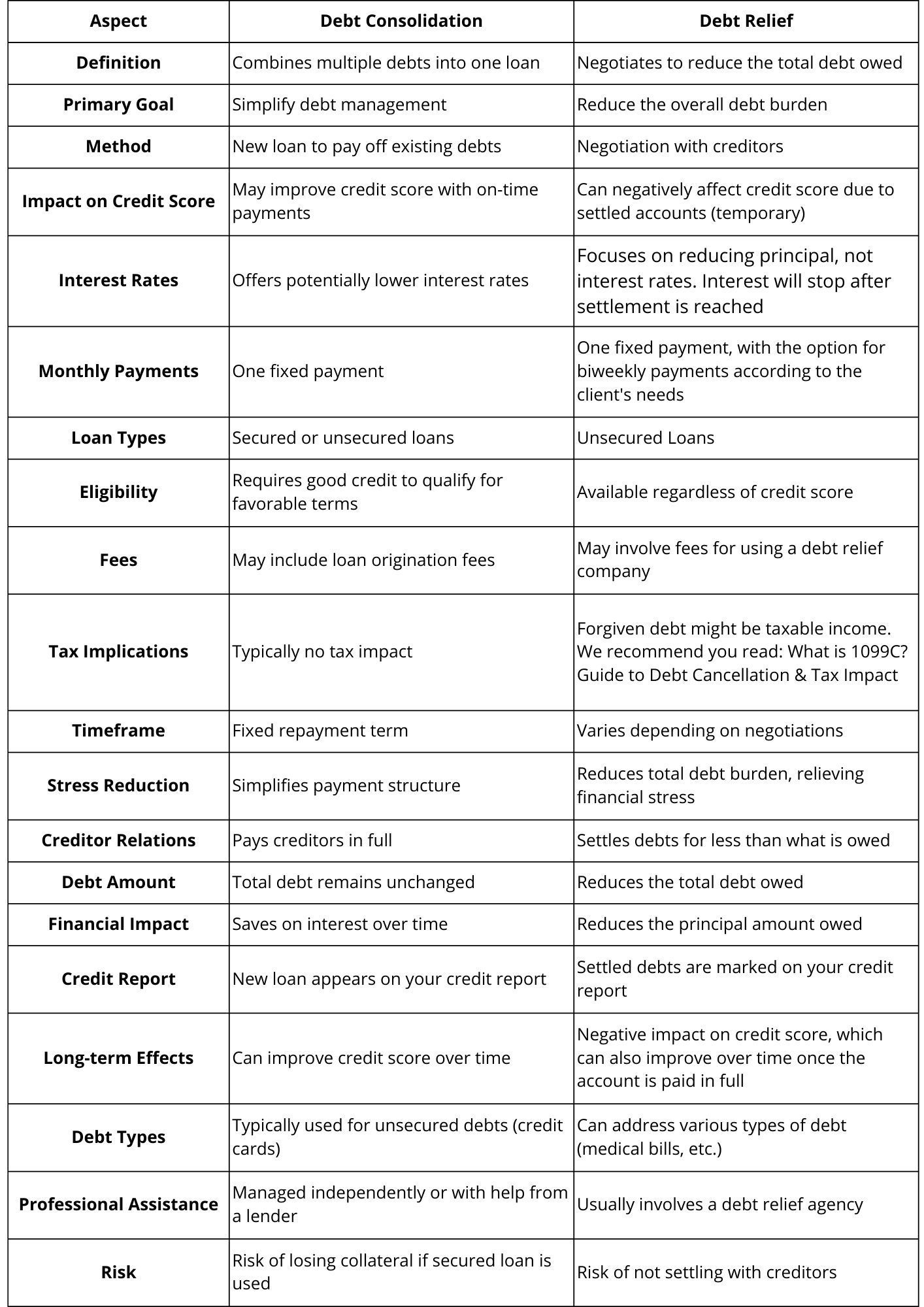

The following comparative table shows the 20 main differences in detail:

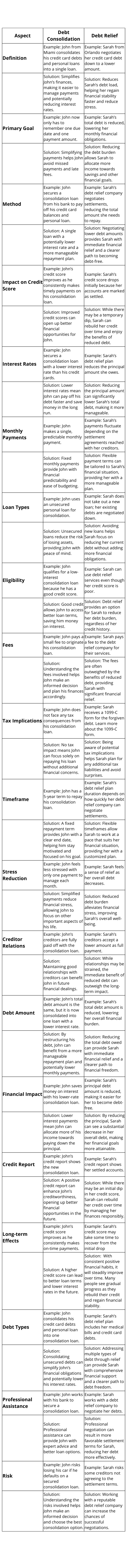

Now, let’s see some examples and solutions for Florida residents that will highlight the practical benefits of these strategies, helping you understand which option might be best suited for your financial situation:

As you can see, for every financial situation there is a solution that fits everyone's needs.

Consult with our Manare Debt Relief team for personalized advice.

Debt Consolidation vs Debt Relief: Which is Better?

Choosing between debt consolidation and debt relief depends on your financial situation:

Debt Consolidation is ideal if you have good credit and want to simplify payments.

- Why: Debt consolidation works best for individuals with a good credit score because it allows them to qualify for loans with lower interest rates. This can make managing debt more straightforward by combining multiple debts into a single monthly payment. It’s particularly beneficial if you’re looking to streamline your finances and reduce the hassle of keeping track of various due dates and interest rates.

- Example: If you have several credit card debts with different interest rates and payment schedules. By consolidating these debts into one loan, you can secure a lower interest rate and have just one monthly payment to manage. This not only simplifies your financial life but can also save you money on interest over time.

Debt Relief is suitable if you’re struggling to make payments and need to reduce the total debt.

- Why: Debt relief is a better option if you’re finding it difficult to keep up with your debt payments. This strategy involves negotiating with creditors to reduce the total amount of debt you owe. It’s particularly useful if you’re facing financial hardship and need immediate relief from overwhelming debt. However, it’s important to note that debt relief can negatively impact your credit score and may have tax implications.

- Example: Suppose you’re unable to make your monthly debt payments and are at risk of defaulting. In this case, negotiating with your creditors to settle your debts for less than what you owe can provide significant relief. For instance, if you owe $10,000 on a credit card, you might negotiate to settle the debt for $6,000, paying off the reduced amount in a lump sum or installments. This can help you avoid bankruptcy and reduce your overall debt burden.

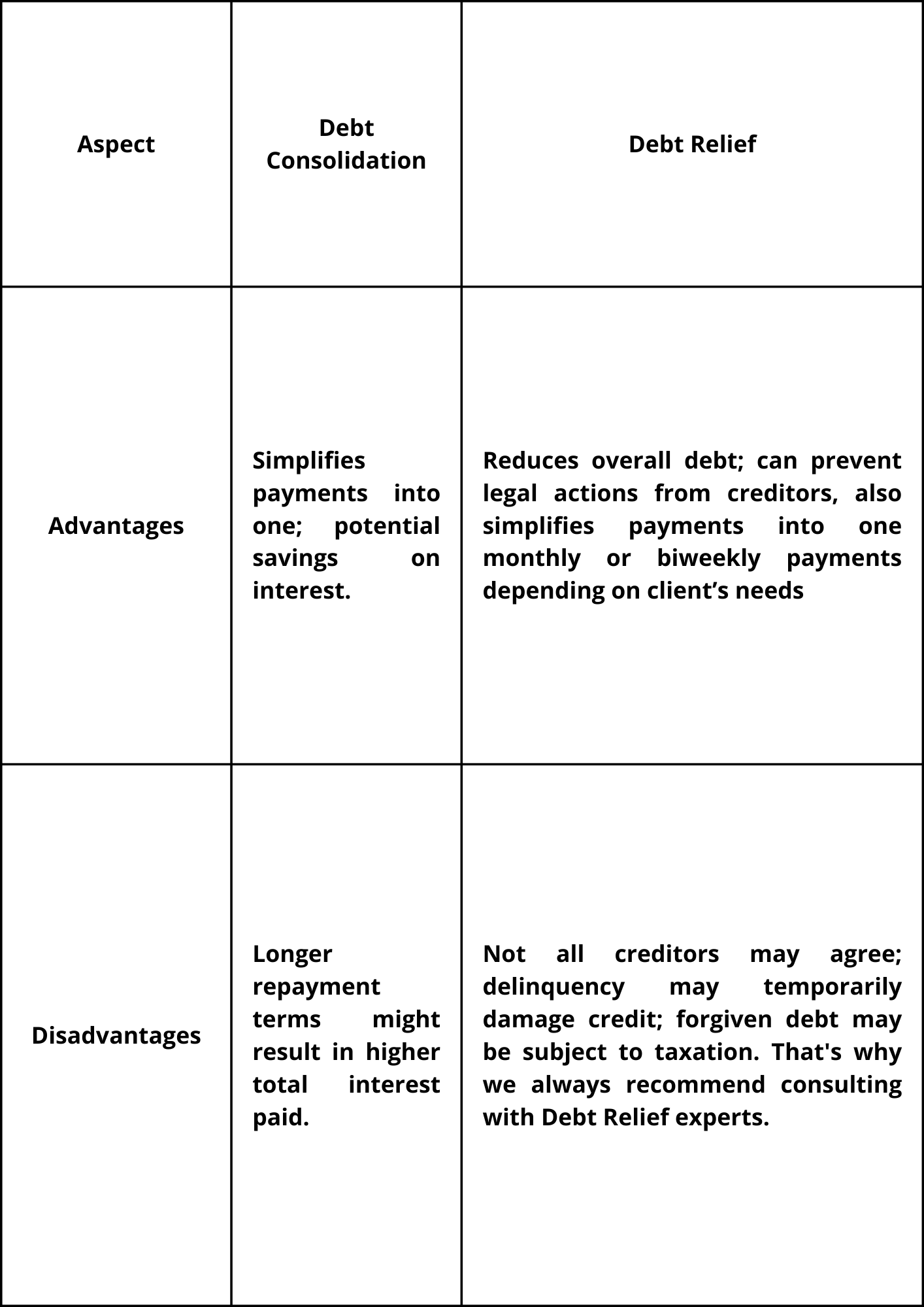

To find out which strategy is best, we also need to understand the advantages and disadvantages of each one:

How Manare Debt Relief Can Help You Be Debt-Free

At

Manare Debt Relief in Florida, we specialize in providing debt relief services tailored to your specific needs.

If you’re a Florida resident struggling with debt, exploring debt relief programs can be one of the steps toward financial stability.

These programs offer tailored solutions to reduce your debt burden and help you regain control of your finances.

For personalized advice and effective debt relief strategies, consider

reaching out to our Manare Debt Relief team.

Remember, both

debt consolidation and

debt relief offer valuable ways to manage debt, but understanding the

key differences can help you make an informed decision.

We hope you found this article on the differences between debt consolidation and debt relief helpful!

If you did, please consider sharing this article with friends, family, or anyone who might benefit from understanding these financial strategies.

Your support helps others make informed decisions about managing their debt and achieving financial stability. Thank you for reading!

Take Control of Your Debt Today!

At Manare Debt Relief, we understand that managing debt can feel overwhelming. That's why we're here to help you navigate your financial journey with personalized debt settlement solutions. Ready to find out how we can assist you?